Table of Content

To encourage more people to buy a home, the Indian Government offers a lot of tax benefits for a home loan. You can claim more tax deductions for housing loans every year under Income Tax. There are deductions available for principal repayment, interest, and stamp duty and registration charges. So, what exactly does it mean to have negative information? What does it imply to be blacklisted by a loan app in Nigeria or anywhere else for that matter? It means that institutions/credit grantors you may approach will deny you credit because you have a negative report on your credit profile.

You just need to make sure that you are using the right lender, and that the lender is registered with the NCR. With any of the three mentioned lenders, you can get your loan approved without any problems. Shop around and look for home loan lenders that offer loans to people with bad credit. They will be able to give you a far better chance of getting a loan as they specialize in loans for people with bad credit.

Where to Find Loans for Blacklisted People in South Africa

Simultaneously, you can also file for a loan from other institutions. For example, you have a budget of ₱1,000 for groceries. Instead of paying with cash, pay it with your credit card. Then, pay the ₱1,000 as soon as your credit card bill arrives. There is a fee to pay and suffice it to say that you must prepare at least ₱200 for the processing. Banks and other companies like those in the telecommunications industry have access to these reports.

First, let us consider the concept of a database as it relates to being blacklisted by a loan app in Nigeria. A Digido employee will call you to discuss recovering the debt. The company then has the right to recover it in court based on the loan agreement. Yes, many companies in the Philippines issue loans legally and have a registration number in the government registry. Do this with your electric bill, water bill, and online purchases. However, make sure that you already have the money to pay for it.

How to check if you are blacklisted for credit in the Philippines

Also, additional documents and a high credit rating will increase your chances of getting one. The first thing you need to do is to pay what you owe on a monthly basis. The credit score is really nothing more than a measurement of how trustworthy you are. To be a trustworthy individual, you must honor your word. We at Blacklisted Loans along with our panel of lenders specialise in assisting ITC listed clients in getting a personal loan today even if you have a judgment or default.

Do this for things where you already have money to make the purchase. If you are not in debt, you can borrow as much as you want. While there is no credit investigation bureau Philippines, there is CMAP that can help you.

Pep loans for blacklisted 2022

At Dot Loans, Loans for Blacklisted consumers are available through trusted and transparent processes, aimed at simplifying a difficult time in your life. Mortgage refinancing for people with a bad credit record. This is something that can help someone to get out of trouble when dealing with large amounts of accumulated debt. These lenders are normally those that are approving loans, even if you can’t afford the loan. They have extremely high-interest rates and are making the process of applying for a loan easier.

These loans for blacklisted people can help you overcome economic difficulties. However, it is always better to actively pay your debt so you get yourself removed from the so-called “black list” and qualify for regular loans again. In South Africa, everyone is entitled to one and full free credit report per year.

We are an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, we may receive compensation from our partners for featured placement of their products or services. If you are blacklisted, it may seem as if your chances of getting a home loan are slim. This is not the case, as there are many options available to give your home loan application a boost.

If you’re still waiting for the bureau to come back with an outcome from this dispute, we suggest delaying all applications for finance until the issue is resolved. The last thing you want is another hit on your credit score until this one is cleared up. Then, if you find anything that does not belong on your report, lodge disputes with the bureaus.

A credit card has a strong influence on your credit score, so try to include at least one of these in the mix. “Paying back your credit card balance has a significant impact on your score, as it’s not just about having the credit, but how you deal with it that the banks are assessing,” explains Cox. You should also try to pay off some of your existing debt before applying for a new loan as this will help improve your chances of getting a loan even if it is just slightly. It is still possible to get a home loan if you are blacklisted. However, you will need to apply for a bond through the special risk department of your chosen bank.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Instant online payday loans, with no paperwork required, are one short-term finance option to consider. Payday loans aren’t the only option for borrowers who have been blacklisted or have difficulty offering paperwork.

S & P Bank Loan Services is a professional team to avail Home Loans for various individuals and Business people in Chennai, Tamil Nadu, India. Should you have a clearance certificate/letter of non-indebtedness, you can forward the letter to the credit bureau for verification from your lender. Either course requires the lender or credit grantor to provide this update to the bureau.

Payday loans with no paperwork or phone calls can be a convenient option if you need to secure short-term funds for emergencies. Do you need some extra cash but have a bad credit score? When you’re approved for a loan, your repayments will generally start on your next payday. Payday loans are known for being costly because of their quick repayment schedule. Many are due two to four weeks after being borrowed, so be sure you can afford it.

Need a Personal Loan? We can assist.

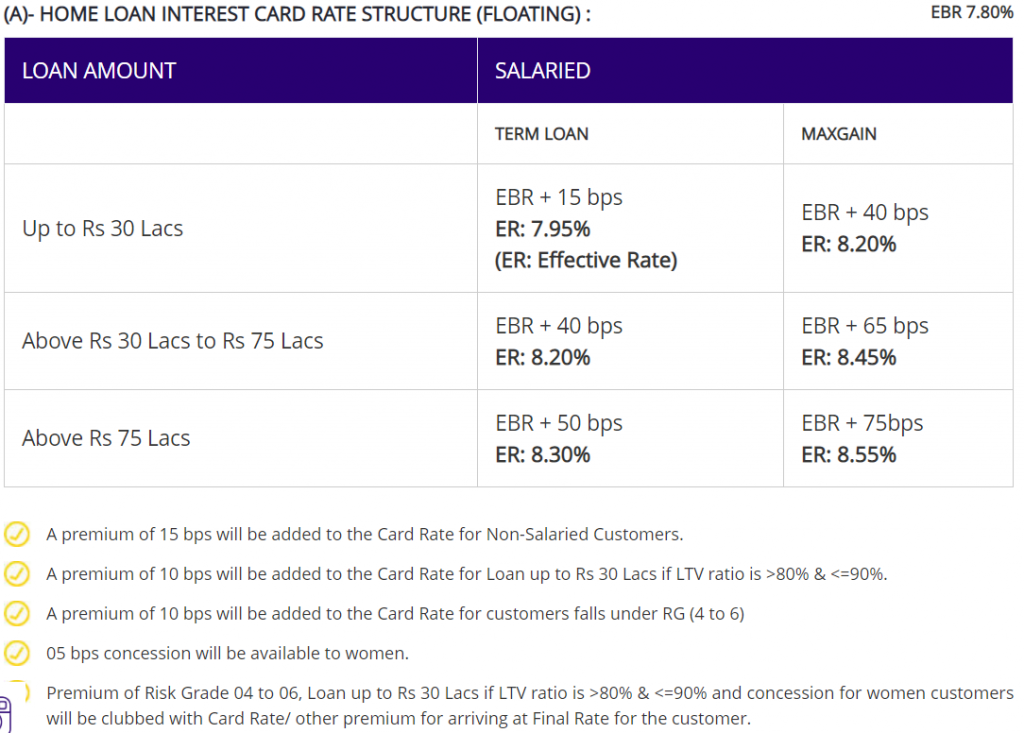

Most people that are blacklisted will be able to get approval for some blacklisted loans. Housing loan comes with a lot of offers and concessions. It offers low-interest-rate with long repayment tenure. It makes monthly EMIs lower so that your monthly expenses are done without liquidity crunch. Whenever you have more funds, you can part pay the housing loan to reduce your liabilities.

No comments:

Post a Comment